State-Owned arms,ammunition and guided missile systems manufacturer Bharat Dynamics Ltd has documented a draft outline with the Securities and Exchange Board of India to drift an IPO.

The Public issue completely involves an secondary market sale of offer. The administration, going about as the promoter, will offer a little more than 22 million offers speaking to around 12.5-13% stake in the organization on a post-issue premise.

BDL is 100% possessed by the Government of India, and the administration will get three years from the date of leaning to bring its stake down to 75% or underneath to meet SEBI’s standards on the base open buoy.

The aggregate issue measure is assessed at Rs 1,000 crore ($157 million), as indicated by two people mindful of the advancement.

BDL will join other PSU defence related related organizations in choosing the capital markets course. Hindustan Aeronautics Ltd (HAL) documented its draft proposition with SEBI in October 2017 subsequent to moving forward and backward on its gets ready for a long time.

A week ago, Mishra Dhatu Nigam Ltd (Midhani) likewise petitioned for a Rs 450 crore IPO. The organization makes extraordinary steels and superalloys, other than being the main maker of titanium combinations in India. Its items have unique applications in parts, for example, barrier, aviation, control age, atomic and other general engineering and designing businesses.

More than two dozen firms, either having substantial SEBI endorsement or have recorded applications to get one, are hoping to go for IPOs. These organizations are hoping to profit by the boom in the secondary markets.

Benchmark equity indices advanced nearly 28% in 2017, and have extended gains so far this year, with indices touching record highs.

BDL, and other PSU offerings, are a piece of the administration’s record Rs 72,500 crore disinvestment focus for 2017-18 and the one for the following budgetary year which will be reported in the forthcoming Union Busget on 1 February.

A week ago, the legislature overhauled its disinvestment focus to Rs 92,000 crore, following Oil and Natural Gas Corp (ONGC’s) procurement of government’s 51.11% stake in state-possessed oil marketing company HPCL.

Here’s a preview of the proposed IPO by BDL

Issue

BDL’s issue measure is evaluated at Rs 1,000 crore ($157 million).

The general population issue totally includes an optional market deal. The administration, going about as the promoter, will offer a little more than 22 million offers speaking to around 12.5-13% stake in the organization on a post-issue premise. BDL is 100% claimed by the Government of India

Utilization of Proceeds

The company will not receive any proceeds from the offer. The entire proceeds will go to the government of india which is the selling shareholder.

Brokers

SBI Capital Markets, IDBI Capital Markets and Securities and Yes Securities are trader financiers and merchant bankers dealing with the IPO.

Legal Lawyers

DSK Legal, Advocates and Solicitors and Riker Danzig, Scherer, Hyland and Perretti LLP are Indian and worldwide lawful insight speaking to the organization and the government in the IPO.

Cyril Amarchand Mangaldas is the lawful consultant to the vendor financiers.

Organization

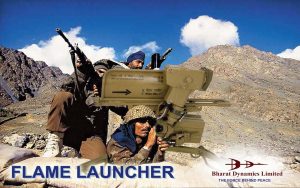

BDL, a main resistance PSU, was consolidated in 1970. It is occupied with making surface to air missiles (SAMs), anti-tank guided missiles (ATGMs), underwater weapons, rocket launchers, countermeasures and test equipment.

It is the sole maker for SAMs in India, torpedoes and ATGMs. The organization is the sole provider of SAMs and ATGMs to the Indian military.

The firm is likewise occupied with the matter of restoration and life augmentation of rockets produced.

BDL is co-creates cutting edge ATGMs and SAMs with Defense Research and Development Organization (DRDO), the national office accountable for military’s innovative work.

The organization works by means of three assembling offices situated in Hyderabad, Bhanur and Visakhapatnam. It is setting up two additionally fabricating offices at Ibrahimpatnam (close Hyderabad) and Amravati in Maharashtra which should be utilized to make SAMs and very short range air defence missiles (VSHORADMs) respectively.

The organization had a request book of Rs 11,164 crore as on 31 October 2017.

Financials

BDL posted a net benefit of Rs 172.59 crore for the a half year finished September 2017 on incomes (from operations) of Rs 1,805.68 crore amid a similar period, as indicated by the draft outline.

Its net profit remained at Rs 490.31 crore in entire year 2016-17 and Rs 562.06 crore in the earlier year.

Its incomes were Rs 4,832.75 crore in financial year 2016-17 and Rs 4,078.75 crore in the earlier year, demonstrated the DRHP.