Weekly Chart study

Chart Analysis: A Promising Breakout for Shyam Metalics & Energy Ltd

In the recent trading week, Shyam Metalics & Energy Ltd demonstrated a significant achievement by surpassing its previous year’s high, reaching a pinnacle of 461.15. What’s even more promising is that the week concluded with a solid weekly close at 464.85, marking a notable breakthrough. This price action was accompanied by a weekly high of 479.90, potentially indicating a rounding top breakout pattern.

Should the stock successfully breach the crucial level of 480, a compelling opportunity for a substantial breakout emerges. This breakout, if realized, could potentially propel the stock’s value to the 670-680 range, spanning a remarkable 200-point move. This projection finds support in the prevailing chart pattern, complemented by the heightened volume, a reliable indicator of strong investor participation.

The rounding bottom breakout on the weekly chart, substantiated by the surge in trading volume, strengthens the case for this anticipated move. The increased volume suggests that investors are entering the market at this juncture with a positive outlook.

In light of this analysis, it’s important to consider 410 as a robust support level on a weekly closing basis. This level holds significance and can serve as a threshold for evaluating the sustainability of the expected bullish momentum.

In conclusion, the current technical analysis indicates a compelling opportunity for Shyam Metalics & Energy Ltd, with a strong potential for a breakout beyond the 480 mark. The rounding bottom breakout pattern, combined with heightened trading volume, suggests a positive sentiment and the potential for a significant upward move towards the 670-680 range. As investors gauge these developments, the 410 support level remains pivotal in assessing the stock’s trajectory moving forward.

About Company

Here are the key points about Shyam Metalics & Energy Ltd in terms of their business, growth, and future plans:

Business:

- Diversified Portfolio: Shyam Metalics & Energy Ltd operates in the metal and energy sectors, with a focus on producing a wide range of products, including iron ore pellets, ferro alloys, steel, and power.

- Integrated Operations: The company follows an integrated business model, encompassing mining, metal production, and energy generation. This integration allows them to optimize production processes and control costs.

- Quality and Innovation: Shyam Metalics & Energy Ltd is known for its emphasis on product quality and continuous innovation. This commitment to excellence has contributed to their reputation within the industry.

- Sustainability Initiatives: The company is likely to have implemented sustainable practices in its operations, such as resource-efficient processes and environmentally friendly technologies, aligning with global trends towards responsible business practices.

Growth:

- Capacity Expansion: Shyam Metalics & Energy Ltd has embarked on a journey of significant capacity expansion, either through organic growth or acquisitions. This expansion indicates a strong growth trajectory and a vision for increased market presence.

- Market Penetration: The company’s growth strategy may include plans to penetrate new markets, both domestically and internationally, thereby broadening its customer base and diversifying its revenue streams.

- Product Diversification: Shyam Metalics & Energy Ltd might be focused on diversifying its product offerings, exploring new metal alloys, steel grades, and other value-added products to cater to evolving industry demands.

- Investment in Technology: To stay competitive and drive growth, the company could be investing in advanced technologies, automation, and digital solutions to optimize processes, improve efficiency, and enhance product quality.

Future Plans:

- Strategic Partnerships: Shyam Metalics & Energy Ltd may be forging strategic partnerships or collaborations with other industry players, technology providers, or research institutions to access new markets, technologies, or expertise.

- Green Initiatives: Given the global shift towards sustainable practices, the company might be focusing on green energy solutions, carbon reduction strategies, and environmentally friendly production methods to align with environmental goals.

- Innovation and Research: The company’s future plans could involve continued emphasis on research and development, aiming to create innovative products, improve processes, and stay ahead of market trends.

- Global Expansion: Shyam Metalics & Energy Ltd could be eyeing international expansion, setting up manufacturing facilities or distribution networks in different regions to tap into emerging markets and increase its global footprint.

- Investor Relations: As part of its future plans, the company may be enhancing its investor relations efforts, communicating its growth strategies, financial performance, and transparency to attract potential investors and stakeholders.

- Human Capital Development: To support its growth and sustainability, Shyam Metalics & Energy Ltd could be investing in talent development, employee training, and creating a conducive work environment.

In summary, Shyam Metalics & Energy Ltd’s business revolves around metal production and energy generation, characterized by a diversified portfolio, emphasis on quality, and sustainability initiatives. Their growth trajectory involves capacity expansion, market penetration, and product diversification, while future plans likely include strategic partnerships, green initiatives, innovation, and global expansion. These factors collectively indicate the company’s commitment to excellence and its strategic vision for a prosperous future.

Fundamental Data

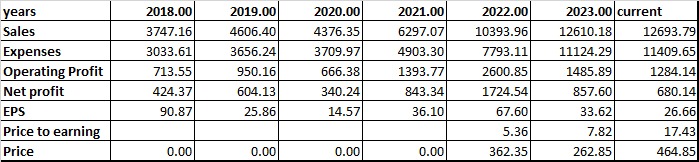

Data Analysis and Trend Overview:

Sales and Expenses: The company’s sales have shown a consistent upward trend over the years, with a significant jump from 2021 to 2022. However, expenses have also increased, albeit at a slightly slower pace, resulting in a generally positive operating profit trend.

Operating Profit: Operating profit experienced fluctuations, with a notable peak in 2022. This could be attributed to increased sales and better cost management. The subsequent dip in 2023 suggests potential challenges or increased costs.

Other Income: Other income remained relatively stable until 2023, where it saw a substantial increase. This could be due to diverse revenue streams or investment gains.

Depreciation and Interest: Depreciation has fluctuated, peaking in 2022 before a slight decrease in 2023. Interest payments have shown a decreasing trend, indicating improved financial management.

Profit Before Tax and Tax: Profit before tax exhibited significant growth in 2022, but dropped in 2023, possibly due to higher expenses. Taxation has generally followed profit trends.

Net Profit and EPS: Net profit has been on an upward trajectory, with 2022 showing a significant leap. Earnings per share (EPS) followed a similar pattern, except for a decrease in 2022, which might be due to increased outstanding shares.

Price and Price-to-Earnings (P/E) Ratio: The stock price was non-existent until 2022 when it reached 362.35. The P/E ratio saw a substantial increase from 2022 to 2023, indicating heightened investor interest.

Conclusion and Future View:

Strong Growth Phase: The company has undergone a period of strong growth, marked by increasing sales, profits, and expanding EPS until 2022.

Challenges in 2023: The dip in operating profit, profit before tax, and net profit in 2023 suggests potential challenges or increased costs that impacted the financial performance.

Investor Interest: The rise in stock price and P/E ratio from 2022 to 2023 implies heightened investor confidence and expectations for future growth.

Future Outlook: The company should focus on managing costs effectively to maintain profitability. Addressing challenges in 2023 will be crucial for sustained growth.

EPS Impact: The fluctuating EPS indicates potential changes in the company’s capital structure or dilution of shares.

Investment Caution: The rising P/E ratio might indicate a higher valuation, cautioning investors to carefully assess the stock’s growth potential.

Diversification and Sustainability: Exploring diverse revenue streams and sustainable business practices can mitigate risks and contribute to future growth.

Market and Industry Trends: The company’s performance should be analyzed alongside broader market and industry trends to understand its competitive position.

In the future, the company’s performance will likely depend on its ability to manage costs, adapt to changing market conditions, and sustain growth. Careful financial management, strategic decision-making, and capitalizing on opportunities will be essential to achieve continued success over the next five years.

Final Conclusion

Final Conclusion: Shyam Metalics & Energy Ltd – A Comprehensive Analysis

Based on the combination of financial analysis and technical indicators provided, a holistic picture of Shyam Metalics & Energy Ltd emerges, encompassing its financial performance, market trends, and potential future prospects.

Financial Analysis:

- Steady Growth Trajectory: The company has demonstrated a consistent growth trajectory over the past years, marked by increasing sales, profitability, and EPS. This growth underscores its ability to capitalize on market opportunities and manage operations effectively.

- Operational Efficiency: Despite fluctuations, the company’s operating profit has shown positive trends, indicating its ability to optimize costs and maintain profitability.

- Investor Interest: The rise in net profit and EPS, especially in 2022, suggests strong financial performance and effective capital utilization.

- Challenges in 2023: The dip in certain financial metrics in 2023 implies potential challenges or increased costs that need to be addressed for sustained growth.

- Investment Caution: The rising P/E ratio indicates heightened investor interest but also raises caution regarding potential overvaluation.

Technical Analysis:

- Breakout Potential: The stock’s recent price movement, especially the ability to surpass its previous high and close above it, suggests potential for a breakout from a technical perspective.

- Rounding Top Breakout Pattern: The price movement resembles a rounding top breakout pattern, indicating potential for a significant upward move if the stock surpasses the 480 level.

- Volume Confirmation: The accompanying increase in trading volume during the breakout phase indicates strong investor interest and participation, reinforcing the potential for a significant move.

Company Information:

- Diversified Portfolio: Shyam Metalics & Energy Ltd operates in the metal and energy sectors, with integrated operations spanning mining, metal production, and energy generation.

- Commitment to Sustainability: The company likely emphasizes sustainability through resource-efficient processes, potentially aligning with broader industry trends.

- Strategic Growth: Shyam Metalics & Energy Ltd’s strategy includes capacity expansion, market penetration, product diversification, and potential global expansion.

Future Outlook:

- Capitalizing on Growth: The company’s future success will depend on its ability to address challenges, effectively manage costs, and capitalize on growth opportunities in both the metal and energy sectors.

- Mitigating Risks: Diversifying revenue streams, focusing on sustainability, and closely monitoring market trends will be vital to mitigate risks and ensure long-term success.

- Investor Consideration: Investors should carefully assess the stock’s valuation, considering the rising P/E ratio, and monitor the company’s response to challenges in 2023.

In conclusion, Shyam Metalics & Energy Ltd has demonstrated a robust growth trajectory, marked by financial strength and technical breakout potential. However, challenges in 2023 warrant attention, and careful strategic management will be essential for sustained success. Investors should balance optimism with prudent evaluation and remain attuned to market dynamics to make informed decisions regarding their investment in the company.