Chart Study

Upon analyzing the presented chart, it becomes apparent that the stock is currently forming a “symmetrical triangle” chart pattern. A potential breakout seems imminent if the stock manages to breach the crucial resistance at 275 and sustain that level upon closing. This breakout confirmation could signify the emergence of a significant bullish trend, in line with the pattern’s characteristics.

Should the breakout materialize, technical analysis suggests a prospective upward target around the 358 mark within the upcoming days. It is worth noting that the pattern’s integrity should be established prior to making any trading decisions.

Furthermore, the support zone around 230 appears robust and reliable, offering a potential cushion for any retracements. However, it is advisable to act only after the symmetrical triangle pattern has been definitively validated.

In summary, the stock’s price movement aligns with the symmetrical triangle pattern, hinting at a possible breakout above the 275 level. Successful confirmation of this breakout could set the stage for a bullish trend with an upper target near 358. A formidable support zone exists around 230, but prudent action is recommended post-pattern confirmation.

About Company

Swan Energy Ltd is a prominent Indian energy company engaged in various sectors of the energy industry, including natural gas and renewable energy. Established in 1909, the company has a rich history and has played a significant role in India’s energy landscape. Over the years, Swan Energy has diversified its operations and expanded its presence across multiple segments within the energy sector.

Key areas of focus for Swan Energy Ltd include:

- Natural Gas Infrastructure: Swan Energy is involved in the development and operation of natural gas infrastructure, including liquefied natural gas (LNG) terminals and regasification facilities. These facilities play a crucial role in the import, storage, and distribution of natural gas, contributing to India’s energy security and supporting the country’s growing demand for clean and efficient energy sources.

- Renewable Energy: Recognizing the global shift towards renewable energy sources, Swan Energy has also ventured into the renewable energy sector. The company is involved in exploring and developing clean energy solutions, such as solar power projects, to contribute to India’s renewable energy goals and reduce carbon emissions.

- Infrastructure Development: Beyond its core energy operations, Swan Energy is also involved in infrastructure development projects. This includes activities such as real estate development, where the company leverages its expertise to create sustainable and modern spaces that align with urban development trends.

- Trading and Marketing: Swan Energy engages in trading and marketing activities related to energy commodities. This aspect of their business involves buying and selling natural gas and other energy products, contributing to the efficient distribution of energy resources.

Fundamental Data Analysis

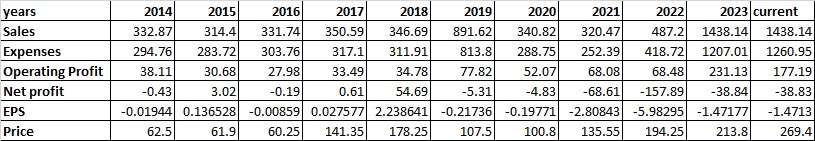

Data Trend Analysis for Swan Energy Ltd (2014-2023)

The provided data offers a snapshot of Swan Energy Ltd’s financial performance over the years. Let’s analyze the trends and draw conclusions from the data:

Sales and Expenses: The sales figures have been relatively consistent, with some fluctuations from year to year. However, there was a significant surge in 2019 and 2023, indicating potential growth and expansion. Expenses have also followed a similar pattern, reflecting the company’s efforts to manage costs despite the increase in sales.

Operating Profit: The operating profit has shown moderate growth over the years, with a substantial jump in 2019. This suggests improved operational efficiency and profitability during this period.

Other Income: The company experienced a notable spike in other income in 2018, primarily driven by a substantial increase in 2018. This could be attributed to specific non-operational factors such as one-time gains or investments.

Depreciation and Interest: Both depreciation and interest expenses have generally increased, possibly due to investments in infrastructure and financing activities. The significant rise in interest expenses from 2018 to 2022 could be a point of concern, potentially impacting the company’s profitability and financial health.

Profit Before Tax (PBT) and Net Profit: The PBT shows fluctuating trends, including both positive and negative values. The net profit also displays volatility, with notable negative values in 2019, 2021, and 2022. These negative figures could indicate periods of financial challenges or specific events impacting profitability.

Earnings Per Share (EPS) and Price-to-Earnings (P/E) Ratio: The EPS shows fluctuations, including negative values during some years. The P/E ratio indicates the market’s perception of the company’s earnings potential relative to its stock price. The highly negative P/E ratio in certain years suggests market skepticism about the company’s earnings and growth prospects.

Stock Price: The stock price has experienced substantial fluctuations, particularly evident in the sharp rise from 2018 to 2020 and a gradual increase thereafter.

Conclusion and Future View:

Swan Energy Ltd has displayed a mixed performance over the past years, with periods of growth and challenges. The significant increase in sales in 2019 and 2023 is a positive sign, reflecting potential expansion and revenue generation. However, the company has also faced periods of negative net profit and challenging profitability, possibly linked to higher expenses and interest payments.

Looking ahead, Swan Energy Ltd’s future prospects depend on various factors, including its ability to manage expenses, improve operational efficiency, and address the concerns around negative profitability. The company’s expansion into renewable energy projects could offer new growth avenues, given the increasing emphasis on sustainability and clean energy solutions. Addressing the rising interest expenses and maintaining a positive net profit will be crucial for financial stability and investor confidence.

Investors should consider a comprehensive analysis of Swan Energy Ltd’s financial health, market trends, and industry developments before making investment decisions. Monitoring the company’s efforts to enhance profitability, manage debt, and capitalize on growth opportunities will be essential for projecting its future trajectory over the next five years.

Final Conclusion: Swan Energy Ltd – A Multi-Faceted Journey Ahead

A comprehensive analysis of Swan Energy Ltd, encompassing both financial and technical aspects, provides insights into the company’s trajectory and potential future outlook. Here’s a holistic conclusion based on the provided data:

Financial Analysis:

- Sales and Expenses: Swan Energy has demonstrated a consistent sales trend, with notable growth spikes in 2019 and 2023, signaling expansion opportunities. Despite fluctuations, the company has managed expenses relatively well, showcasing prudent cost management.

- Profitability and Challenges: While operating profits have gradually improved, periods of negative net profit and substantial interest expenses in recent years have posed challenges to profitability and financial health. These periods warrant further examination and action.

- Diversification Efforts: Swan Energy’s diversification into renewable energy and real estate projects could potentially drive future growth, aligning with evolving market trends and sustainability goals.

Technical Analysis:

- Symmetrical Triangle Breakout: The technical analysis suggests a symmetrical triangle pattern, indicating impending volatility and the potential for a breakout. The critical resistance level of 275 could trigger a bullish trend if breached, projecting an upper target around 358.

- Caution and Confirmation: Investors are advised to exercise caution and await definitive pattern confirmation before acting. The breakout’s successful validation is paramount for making informed investment decisions.

Synthesis and Future Prospects:

Swan Energy Ltd is positioned at a crossroads, offering both challenges and opportunities. The financial analysis highlights periods of growth and challenges, underscoring the importance of managing expenses and interest payments to sustain profitability. The company’s diversification efforts into renewable energy align with global trends, presenting avenues for future expansion.

From a technical perspective, the symmetrical triangle breakout potential hints at an exciting phase if confirmed. This breakout could spark investor interest and potentially drive the stock price higher, complementing the company’s growth initiatives.

In conclusion, Swan Energy Ltd embarks on a multi-faceted journey, guided by its financial performance, diversification endeavors, and technical patterns. Investors should closely monitor the company’s financial stability, expense management, and success in capitalizing on new ventures. A successful breakout could contribute to renewed investor confidence and a positive trajectory. However, vigilant assessment and a well-informed approach remain essential to navigate Swan Energy Ltd’s intricate path towards a promising future.