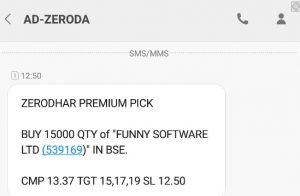

The Securities Exchange Board of India and Stock Exchanges have warned about fake and speculative SMS’s being circulated in the name of certain companies suggesting increase in their market price. Investors have been alerted and warned from time to time through Sebi and exchanges to not blindly follow such tips and analysis and also do thorough analysis and research about the company before investing.

Those getting unsolicited SMSs can report to +91 7506840578. BSE has also alerted investors against involving or participating in any prize money schemes or competitions by third parties or associates of brokers.

The following are the scrips in whose name fake SMS was being circulated-Alps Motor Finance Ltd, Birdhi Chand Pannalal Agencies ltd, Shri Krishna Prasadam Ltd, Sunstar Realty Development Ltd, Aplaya Creations Ltd, Kalpa Commercial Ltd, Amsons Apparel Ltd, Ejecta Marketing Ltd, Sawaca Business Machines Ltd, Funny Software Ltd, Viji Finance Ltd, Kapil Raj Finance Ltd, Sreshta Finvest Ltd, Kids Medical Systems Ltd.

This is a clear attempt to lure investors into buying the scrip on hopes of a supposed open offer happening on 18 April. A closer look at the related news section on the BSE website reveals that both these companies have not reported any such development. This appears to be the handiwork of unscrupulous operators who prey on gullible investors by faking news to boost stock price. Alok Churiwala, MD, Churiwala Securities, says, “There is a systematic racket going on targeting the smaller investor who are deprived of quality and accurate information”.

He adds that it is not just limited to websites but also being pushed via message boards, SMS and social networking platforms like Whatsapp and Facebook. While it is difficult to rein in such operators, investors needs to be alert and caution and stay away from stock market tips. Vaibhav Agrawal, VP-Research, Angel Broking, insists investors buy on the basis of fundamental parameters of the company. “Don’t buy stocks based on random or speculative advice or tips. There are several illiquid stocks which are susceptible to price manipulation.”