Infosys: Will it meet street expectations? – Infosys: A case of great expectations

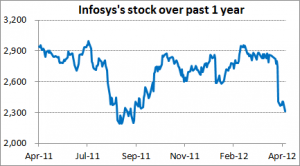

Infosys’ stock has rallied nearly 25% over the past two-odd months following better-than-expected Q3FY13 results.

As India’s Infosys Ltd. 500209.BY +1.70% gears up to report its January-March quarter results Friday, the big question facing investors is whether the technology giant will be able to repeat its stellar performance in the previous three months, when profit beat estimates for the first time in more than two years.

India’s second largest software exporter by sales has already warned of the challenges it faces including the timely closure of contracts and the reluctance of clients to make additional investments in existing projects in a volatile economic climate.

The Bangalore-based company is expected to report a fiscal fourth-quarter net profit of 23 billion rupees ($422 million) on revenue of more than 107 billion rupees based on a poll of 12 analysts. though currency fluctuations could lower revenue.

Financial services budgets likely to shrink in CY13/FY14: Infosys sees IT budgets in the key financial services vertical shrinking in CY13/FY14 owing to muted growth prospects of its clients across all major segments – banking, capital markets and insurance. Greater focus is likely on run-the-business initiatives for cost savings.

Margin pressure to lead to tepid EPS CAGR of 7.6% over FY13E-FY15E, retain Sell: While as per our Fundemental research experts we expects higher revenue growth in FY14 for Infosys compared with FY13, they expect the pressure on margins to lead to a tepid EPS CAGR of just 7.6% over FY13EFY15E. The stock currently trades at 14.9x FY15E EPS, which in their view is not cheap in the light of slow EPS growth expected by us. They believe the possibility of disappointment on high expectations could trigger a stock price correction.

Here are key things to watch out for:

Annual revenue guidance: Many analysts predict that starting in April, Infosys may stop offering guidance. Over the last two years, Infosys has been struggling to set realistic sales growth targets as the economic climate in two of its major outsourcing markets–the U.S. and Europe–remained volatile

Operating margin outlook:

Stock surge implies great expectations, revenue growth seen at the cost of margins.

Margins to remain under pressure; Q3 EBIT margin at a 22-quarter low.

Overall demand for outsourcing services: The pipeline of outsourcing deals for Infosys is looking better, analysts say, though the company is likely to tone down its demand outlook to deliver ahead of expectations.

Currency fluctuations: A 3% on average fall in the value of the British pound against the U.S. dollar is likely to trim Infosys’ revenue in dollar terms. Many outsourcers, including Infosys, convert all their foreign revenue first into dollars and then into rupees. A weak British pound will fetch fewer dollars for the outsourcing companies, pushing down the revenue in dollar terms. Infosys has the least exposure to the British pound among the top Indian IT firms, though this fluctuation could pose a threat to Infosys meeting its own revenue growth target for this fiscal year.

Technical Research Report

Date:- 10/4/2013

Positional dual call (buy/sell)

Script name – INFOSYS LTD

Technical call – buy INFOSYS if cross and close above 2840 level sl 2740 target 2980-3200

Sell INFOSYS if break and close below 2740 level sl 2900 target 2500-2300

Holding period – 2-3 months

Technical view – technical study indicate that Infosys is trading in very crucial range of 2740-2840 levels. Infosys having 70MA support at almost 2770 level and yet it’s not able to close below this level for two successive session for and selling confirmation. Infosys has touch the lower Bollinger band at 2780 level on 9th April 2013 but in next trading session it has for green candle on chart with the indication of “BULLISH HARAMI CANDLESTICK PATTERN” and this indicate of less chances of Bollinger band riding on lower side. Even RSI also indicate that it has almost touch the horizontal support level of 33-34 range and before braking this level and before going into oversold zone price chart has started giving green candle on chart from 10th April 10, 2013. Also STOCHASTIC has already entered into oversold zone below 10 levels.

Technical study output – overall study give us output as if Infosys able to give close and trade above 2840 level then we may confirm its reversal on chart and we may follow buy signal with given stop loss and target levels. But if it is not able to sustain upside and if its braking its crucial support level of 2740 and if give close below this level then we can consider it as sell call confirmation and we will follow levels which are provided in call.

The article has been written for educational purpose. The article reflects our understanding of Fundemental and Technicak Research of the situation. Please feel free to correct me if I have read the data incorrectly. I am in no way suggesting that the above data is final and accurate. Please do your own due diligence before making any investment decision.